As a small business owner in the United States, managing your finances can be a daunting task. Bookkeeping is a crucial aspect of running a successful enterprise, and it involves recording, classifying, and summarizing financial transactions. While some entrepreneurs may attempt to handle bookkeeping themselves, the complexities of accounting principles and ever-changing tax laws often necessitate the assistance of professional small business bookkeeping services.

In the dynamic landscape of the American economy, small businesses play a vital role in driving innovation, creating jobs, and fostering economic growth. However, navigating the intricate world of finance can be overwhelming, especially for those without formal accounting training. This is where small business bookkeeping services come into play, offering a lifeline to entrepreneurs who seek to streamline their financial operations and ensure compliance with regulatory requirements.

Why small business bookkeeping services are important

Accurate and up-to-date financial records are the backbone of any thriving business. Small business bookkeeping services provide a multitude of benefits that can significantly impact the success and longevity of your venture. Here are a few reasons why these services are crucial:

- Time-saving: Bookkeeping can be a time-consuming endeavor, diverting your attention from core business operations. By outsourcing this task to professionals, you can focus on strategic decision-making, product development, and customer acquisition.

- Expertise and accuracy: Experienced bookkeepers possess in-depth knowledge of accounting principles, tax laws, and industry-specific regulations. Their expertise ensures that your financial records are accurate, minimizing the risk of costly errors or penalties.

- Financial insights: Comprehensive bookkeeping services not only maintain your records but also provide valuable insights into your business’s financial health. This information can inform critical decisions regarding cash flow management, budgeting, and growth strategies.

- Compliance: Navigating the ever-changing landscape of tax laws and regulations can be a minefield for small business owners. Professional bookkeeping services ensure that your business remains compliant, reducing the risk of audits or legal complications.

The benefits of outsourcing bookkeeping services for small businesses

While some small business owners may be tempted to handle bookkeeping in-house, outsourcing this critical function to specialized service providers can offer numerous advantages:

- Cost-effectiveness: Hiring a full-time in-house bookkeeper can be a significant financial burden for small businesses. Outsourcing bookkeeping services often proves to be a more cost-effective solution, as you only pay for the services you require.

- Scalability: As your business grows, your bookkeeping needs may evolve. Outsourcing allows you to easily scale your services up or down, ensuring that you receive the appropriate level of support without the need to hire additional staff.

- Access to expertise: Professional bookkeeping service providers employ teams of experienced accountants and bookkeepers who possess specialized knowledge in various industries and business sectors. This level of expertise is difficult to replicate in-house, especially for small businesses with limited resources.

- Objectivity: External bookkeepers bring an objective perspective to your financial records, reducing the risk of bias or oversight that can occur when tasks are handled internally.

- Continuity and reliability: Outsourcing bookkeeping services ensures continuity and reliability, even in the face of staff turnover or unexpected absences within your organization.

The role of an accountant in small business bookkeeping

While bookkeeping and accounting are closely related disciplines, they serve distinct purposes in the financial management of a small business. Bookkeepers are responsible for recording and maintaining accurate financial records, while accountants analyze and interpret this data to provide strategic guidance and ensure compliance with tax laws and regulations.

The role of an accountant in small business bookkeeping is multifaceted:

- Financial reporting: Accountants prepare and review financial statements, such as income statements, balance sheets, and cash flow statements, ensuring that they accurately reflect the financial position of the business.

- Tax preparation and planning: Accountants are well-versed in tax laws and regulations, enabling them to prepare and file tax returns, as well as develop tax strategies to minimize liabilities and maximize deductions.

- Auditing and compliance: Accountants conduct internal audits to ensure the accuracy of financial records and compliance with relevant laws and regulations, reducing the risk of penalties or legal issues.

- Business advisory: Accountants leverage their financial expertise to provide valuable insights and recommendations on various aspects of business operations, such as budgeting, forecasting, and strategic decision-making.

While bookkeeping services can maintain accurate financial records, the expertise of an accountant is invaluable in interpreting this data and providing guidance to drive the long-term success of your small business.

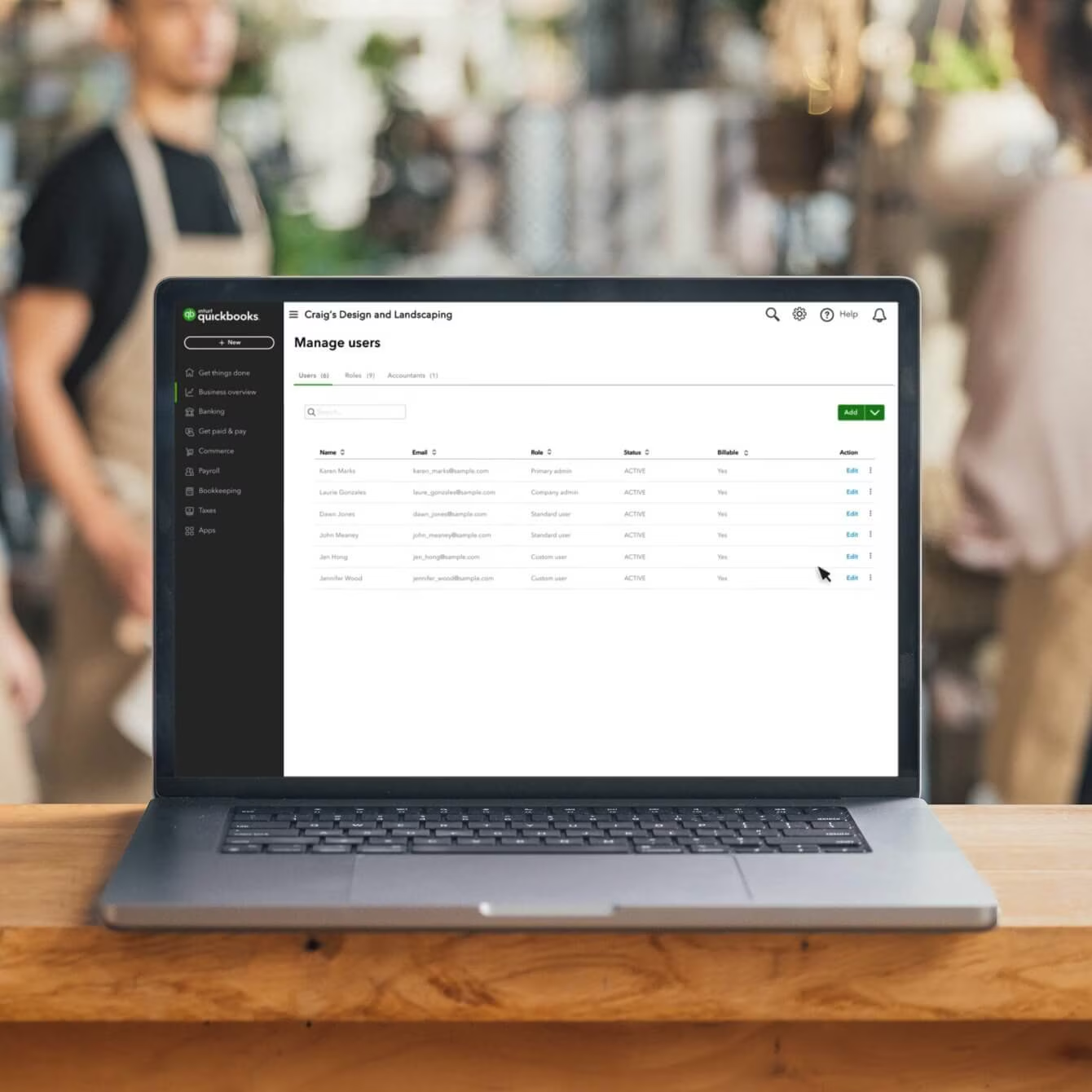

Understanding QuickBooks and its features

QuickBooks is a widely used accounting software designed specifically for small and medium-sized businesses. Developed by Intuit, this powerful tool offers a range of features to streamline bookkeeping and accounting processes:

- Automated bookkeeping: QuickBooks automates many bookkeeping tasks, such as invoicing, expense tracking, and bank reconciliation, saving time and reducing the risk of errors.

- Financial reporting: The software generates various financial reports, including profit and loss statements, balance sheets, and cash flow statements, providing valuable insights into your business’s financial health.

- Inventory management: For businesses that sell physical products, QuickBooks offers inventory tracking capabilities, helping you monitor stock levels and manage orders efficiently.

- Payroll processing: The software can handle payroll calculations, tax deductions, and payroll tax filings, simplifying the process of paying employees.

- Multi-user access: QuickBooks allows multiple users to access the software simultaneously, enabling collaboration and real-time updates across your team.

While QuickBooks is a powerful tool, it is essential to understand that it is primarily designed for bookkeeping and accounting purposes. The software may not provide the same level of expertise and strategic guidance as a professional accountant, especially when it comes to complex financial analysis, tax planning, and business advisory services.

Can QuickBooks replace the need for an accountant?

The question of whether QuickBooks can replace the need for an accountant is a common one among small business owners. While the software offers a comprehensive set of bookkeeping and accounting features, it is important to recognize its limitations and the value that a professional accountant can bring to your business.

Here are some factors to consider:

- Complexity of financial operations: As your business grows and its financial operations become more complex, the need for expert guidance and analysis from an accountant becomes increasingly important.

- Tax planning and compliance: While QuickBooks can assist with tax calculations and filings, an accountant’s expertise in tax laws and strategies can help you minimize liabilities and maximize deductions.

- Financial analysis and forecasting: Accountants possess the skills and experience to interpret financial data, identify trends, and provide valuable insights for strategic decision-making and forecasting.

- Business advisory: Beyond bookkeeping and accounting, accountants can offer comprehensive business advisory services, helping you navigate challenges, identify opportunities, and make informed decisions.

- Audit preparedness: In the event of an audit or legal inquiry, having an accountant on your team can ensure that your financial records are accurate and compliant, reducing the risk of penalties or legal issues.

While QuickBooks is an excellent tool for streamlining bookkeeping tasks, it should be viewed as a complement to, rather than a replacement for, the expertise and guidance of a professional accountant.

Factors to consider when deciding whether to hire an accountant

When determining whether to hire an accountant for your small business, there are several factors to consider:

- Business size and complexity: As your business grows and its financial operations become more intricate, the need for an accountant’s expertise increases. Complex transactions, multiple revenue streams, or international operations may necessitate professional accounting services.

- Industry-specific regulations: Certain industries, such as healthcare, construction, or finance, are subject to specific regulations and reporting requirements. An accountant with industry-specific knowledge can ensure compliance and minimize legal risks.

- Growth plans and financing needs: If you plan to seek external financing or expand your business, an accountant can assist with financial projections, loan applications, and investor presentations, increasing your chances of securing funding.

- Tax planning and compliance: Tax laws are constantly evolving, and an accountant can help you navigate these changes, identify deductions, and develop strategies to minimize your tax liabilities.

- Time and resource constraints: If you or your team lack the time or expertise to handle complex accounting tasks, hiring an accountant can free up valuable resources and ensure accurate financial management.

- Cost-benefit analysis: While hiring an accountant represents an additional expense, the potential savings from tax optimization, financial insights, and risk mitigation may outweigh the costs in the long run.

By carefully evaluating these factors, you can determine whether the expertise and guidance of an accountant align with your small business’s needs and goals.

How small business bookkeeping services can help optimize QuickBooks

While QuickBooks is a powerful tool for small business bookkeeping, its effectiveness can be further enhanced by leveraging the expertise of professional bookkeeping services. Here are some ways in which these services can help optimize your QuickBooks experience:

- Data entry and reconciliation: Experienced bookkeepers can ensure accurate and timely data entry, reducing the risk of errors and inconsistencies in your financial records.

- Customization and setup: Bookkeeping services can tailor QuickBooks to your specific business needs, configuring settings, customizing reports, and integrating third-party applications for seamless operations.

- Training and support: Professional bookkeepers can provide comprehensive training to your team, ensuring they understand how to effectively utilize QuickBooks and its various features.

- Ongoing maintenance and updates: As QuickBooks releases new updates and features, bookkeeping services can ensure your software remains up-to-date and optimized for your business’s evolving needs.

- Financial analysis and reporting: While QuickBooks generates financial reports, bookkeeping services can provide in-depth analysis and insights, helping you make informed decisions based on your financial data.

- Audit preparedness: By maintaining accurate and compliant financial records, bookkeeping services can ensure your business is well-prepared for potential audits or legal inquiries.

By combining the power of QuickBooks with the expertise of professional bookkeeping services, small business owners can streamline their financial operations, gain valuable insights, and focus on driving growth and success.

Finding the right accounting services for small businesses in USA

In the dynamic landscape of the American economy, finding the right accounting services for your small business is essential for long-term success. Here are some tips to help you navigate the process:

- Define your needs: Clearly identify your business’s specific accounting and bookkeeping requirements, including tax planning, financial reporting, payroll processing, and industry-specific compliance.

- Research and referrals: Seek recommendations from trusted sources, such as fellow business owners, industry associations, or professional organizations. Online reviews can also provide valuable insights into the reputation and quality of accounting firms.

- Evaluate expertise and qualifications: Ensure that the accounting service providers you consider have the necessary qualifications, certifications, and experience to meet your business’s needs. Look for firms with industry-specific expertise if applicable.

- Assess communication and responsiveness: Effective communication is crucial when working with an accounting firm. Evaluate their responsiveness, transparency, and ability to explain complex financial concepts in clear, understandable terms.

- Consider fees and pricing structures: While cost should not be the sole deciding factor, it is important to understand the fees and pricing structures of different accounting service providers. Seek transparent and competitive pricing aligned with your budget.

- Review service offerings: Assess the range of services offered by the accounting firm, ensuring they can address your current and future needs as your business grows and evolves.

- Prioritize compatibility and trust: Building a strong working relationship with your accounting service provider is essential. Look for a firm that aligns with your business values, communication style, and overall approach to financial management.

By carefully evaluating potential accounting service providers and finding the right fit for your small business, you can gain a valuable partner in navigating the complexities of financial management and achieving long-term success.

Conclusion and final thoughts on small business bookkeeping services in the USA

In the dynamic and competitive landscape of the American economy, small businesses play a vital role in driving innovation, job creation, and economic growth. However, navigating the intricate world of financial management can be a daunting task, particularly for entrepreneurs without formal accounting training. This is where the importance of professional small business bookkeeping services becomes evident.

While tools like QuickBooks offer powerful features for streamlining bookkeeping tasks, they should be viewed as complementary to the expertise and guidance of professional accountants. Accountants bring invaluable skills in financial analysis, tax planning, compliance, and strategic advisory services, enabling small business owners to make informed decisions and drive long-term success.

By outsourcing bookkeeping services, small businesses can benefit from cost-effective solutions, access to specialized expertise, scalability, and objectivity in financial management. Moreover, these services can help optimize the use of QuickBooks, ensuring accurate data entry, customization, training, and ongoing maintenance.**If you’re a small business owner in the USA and you’re wondering, “Do I need an accountant if I use QuickBooks?”, the answer is a resounding yes.** While QuickBooks is an excellent tool for streamlining bookkeeping tasks, it cannot replace the expertise and strategic guidance of a professional accountant. By partnering with a reputable accounting firm, you can gain valuable insights, minimize tax liabilities, ensure compliance, and make informed decisions to drive the growth and success of your business.

In conclusion, the importance of small business bookkeeping services in USA cannot be overstated. By leveraging the expertise of professional bookkeepers and accountants, small business owners can focus on their core operations, mitigate risks, and navigate the complexities of financial management with confidence. Invest in these services to unlock the full potential of your business and pave the way for long-term success in the dynamic American economy.

Don’t hesitate to explore professional small business bookkeeping services in USA and find the right accounting partner to support your financial management needs.

https://accounting.profitspear.com/