In today’s financial landscape, your CIBIL score holds significant importance. It can heavily influence your ability to secure loans, mortgages, and credit cards. While many financial institutions offer to share your CIBIL score for a fee, the prospect of obtaining a free CIBIL score is certainly appealing. So, the question arises: Is it possible to get a free CIBIL score? Thankfully, the answer is yes. In this article, we will delve into the nuances of a CIBIL score, why it is essential, and the steps to obtain it for free.

Understanding the CIBIL Score

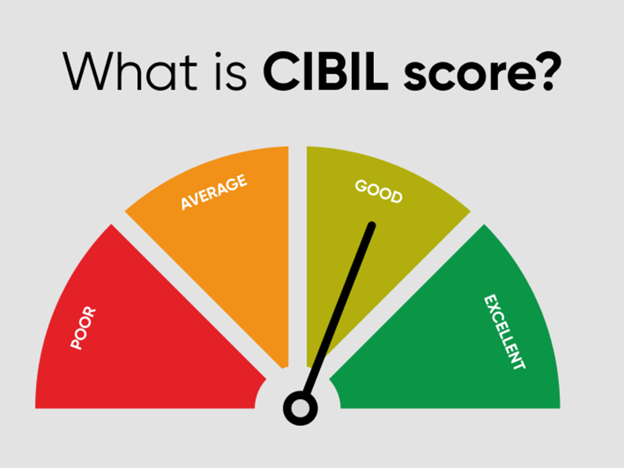

Before we dive into how you can obtain a free CIBIL score, it is crucial to understand what a CIBIL score is. A CIBIL score is a three-digit numeric summary of your credit history, ranging from 300 to 900. A score closer to 900 is considered excellent and indicates a strong credit history. This score is derived based on your credit behavior and is provided by CIBIL (Credit Information Bureau (India) Limited), a prominent credit bureau in India.

Why Your CIBIL Score Matters

Your CIBIL score is more than just a number; it represents your creditworthiness. Financial institutions and other lenders use it to assess the risk of lending to you. Here are a few key reasons why maintaining a good CIBIL score is essential:

1. Loan Approvals: A high CIBIL score increases your chances of loan approvals.

2. Lower Interest Rates: With a good CIBIL score, lenders may offer you loans at lower interest rates.

3. Better Negotiation Power: A strong CIBIL score gives you an edge in negotiating loan terms.

4. Credit Card Approvals: Similar to loans, a good score enhances your chances of getting approved for credit cards.

Given its importance, monitoring your CIBIL score regularly is a financially prudent practice.

Obtaining a Free CIBIL Score

Now that we understand the significance of a CIBIL score, let’s explore how to obtain it for free. Numerous avenues allow you to check your CIBIL score without any cost. Here’s a step-by-step guide:

1. Visit the CIBIL Website

CIBIL offers one free report per year to consumers who visit the official CIBIL website. Here is how you can get it:

– Step 1: Go to the CIBIL website.

– Step 2: Find the section labeled ‘Get Your Free CIBIL Score & Report.’

– Step 3: Fill in your personal details, such as name, date of birth, email ID, and identity proof number.

– Step 4: Create an account and log in.

– Step 5: Answer some questions regarding your credit history to verify your identity.

– Step 6: Once verified, you can view your free CIBIL score and report.

This report provides you with a detailed view of your credit history, allowing you to stay informed of your credit standing.

2. Utilize Financial A$pps

Several financial apps and fintech companies in India provide the service of checking your CIBIL score for free. These apps collaborate with credit bureaus to offer consumers their credit scores. Here are some popular apps:

– Paisabazaar

– BankBazaar

– Freecharge

– Wishfin

To use these apps:

– Step 1: Download the app from your phone’s app store.

– Step 2: Register and create an account.

– Step 3: Provide personal and financial details.

– Step 4: Request to view your CIBIL score.

These apps usually update your score regularly and offer insights into improving your credit health.

3. Banks and Credit Card Providers

Many banks and credit card companies offer free credit score checks to their existing customers. Banks such as HDFC, ICICI, and SBI provide this benefit as part of their customer services. To access your score through these providers:

– Step 1: Log in to your online banking account.

– Step 2: Navigate to the section that offers credit score services.

– Step 3: Request your CIBIL score.

4. Credit Advisors and Financial Counselors

Some credit advisors and financial counselors also provide free credit score services as part of their offerings. They help you understand your CIBIL score and advise on improving it. While this might not always be free, it can be a valuable resource if you need professional advice.

Maximizing the Benefits of Your Free CIBIL Score

Knowing your CIBIL score is only the first step. The real advantage lies in using this information to improve your financial health. Here’s how you can make the most out of your free CIBIL score:

1. Regular Monitoring

Check your CIBIL score regularly to spot any discrepancies. Regular monitoring ensures you can catch and correct errors that may negatively impact your credit score.

2. Improving Your Score

Use the insights from your CIBIL report to create a plan to enhance your credit health. Pay off outstanding debts, avoid late payments, and maintain a low credit utilization ratio.

3. Financial Planning

A good CIBIL score provides leverage in financial planning. Whether you are looking at buying a home, car, or starting a business, knowing your credit standing helps you make informed decisions.

Understanding CIBIL Consumer Reports

It’s not just the CIBIL score that matters; the detailed CIBIL consumer report provides a comprehensive overview of your credit history. This report includes:

– Personal Information: Name, age, gender, identification numbers.

– Contact Information: Residential addresses, phone numbers.

– Loan Accounts: Details of loans, credit cards, and their repayment history.

– Enquiry Information: Records of lenders who have checked your report in the past.

Regularly reviewing your CIBIL consumer report ensures that all your information is accurate and up-to-date. Discrepancies, if any, can be addressed promptly.

Conclusion

Obtaining a free CIBIL score is indeed possible through various methods, including the official CIBIL website, financial apps, banks, and credit advisors. Regularly monitoring your score and making efforts to improve it can significantly impact your financial health. Understanding both your CIBIL score and CIBIL consumer report provides a clear picture of your credit status, allowing you to make better financial decisions.

Whether you’re planning to apply for a new line of credit, aiming to get better terms on a loan, or simply managing your financial standing, your CIBIL score plays a pivotal role. Take advantage of the free resources available to keep a tab on your CIBIL score and maintain a strong credit profile. Remember, a good CIBIL score is not just about accessing credit but about securing your financial future.